Blog

Insights

Behind the Label: LGI’s Thoughtful Approach to Private Wine Brands in the US Market

How LGI Wines crafts tailored, scalable private labels for US shelves

Over the past two and a half decades, LGI Wines has quietly established itself as a force in the private label wine space—particularly in export markets like the US. But their growth hasn’t come from splashy branding or trend-chasing. Instead, it’s built on careful listening, smart adaptation, and deep partnerships with retailers and distributors.

In this interview, Sophie de Lamer Pike, who leads LGI’s North American operations, shares a grounded perspective on what’s driving growth for private labels in a shifting US market—from changing consumer preferences to the challenges of distribution and tariffs. She walks us through LGI’s tailored approach to wine development, their focus on value without compromise, and the ways they’re responding to the demand for sustainability, lighter styles, and relevance across generational divides.

Through it all, one thing is clear: behind every successful private label is a team that understands when to lead, when to support, and when to simply listen.

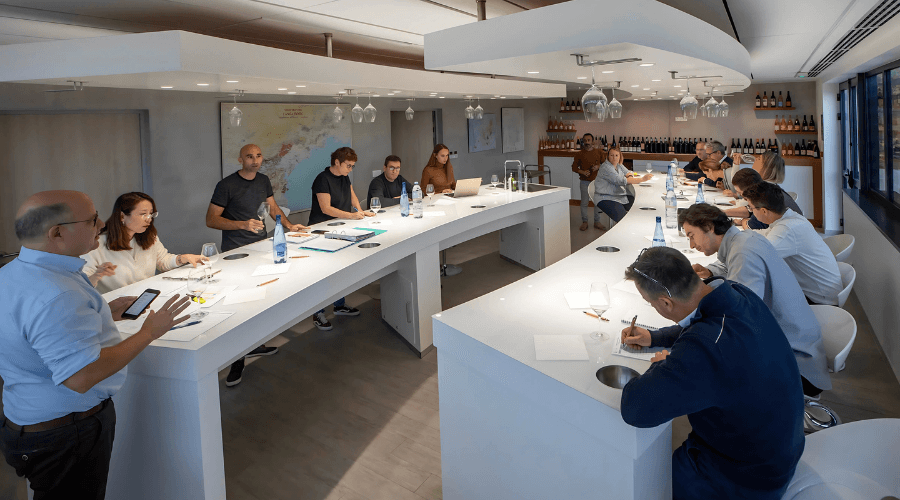

Image: LGI Wines.

LGI Wines is known for their expertise in private label production, particularly for export markets. How does LGI differentiate its private label offerings in the highly competitive US market?

LGI Wines’ strength is in the ability to listen to our customers' needs and, from that conversation, tailor a product that’s adapted to their needs/customers. We do not prescribe a wine but work together to identify what will work and then create those products with our winemakers and packaging designers. This approach has been key to our growth over the past 25 years, reaching 4 million cases produced and sold in 2024.

What do US retailers and distributors look for in private-label wine partnerships? How does LGI help clients develop unique wines that stand out on the shelves?

US retailers and distributors look for reputable partners that provide consistently high-quality wines at a good value to their customers. They also look for flexibility, communication, expertise on market trends, and the ability to scale rapidly when a product takes off.

One of the advantages of private labels is that retailers are in full control of their margin structure. They can bring high-quality/ fairly priced wines to the consumer while making high margins, which improves their bottom line.

With 25 years of experience working with retailers and distributors around the world, we have a good understanding of how to bring our customers' ideas to life while guiding them with what we see works in other similar markets and providing that value.

Image: New Headquarters, LGI Wines.

Many US retailers are expanding their private label portfolios. Can you share examples of successful collaborations LGI has had with major retail or restaurant chains?

We have launched many successful programs over the years and have collaborated with Whole Foods, Total Wines, Heinen’s, and Wegmans, to name a few.

With the private-label wine sector growing in the US, what strategies is LGI using to expand its presence and secure new retail partnerships?

We just added a person to our team to continue developing our relationships with US customers. We also attend trade shows such as the IBWSS to meet key players.

Image: IBWSS 2024.

Based on LGI’s experience in the US, what shifts are you seeing in consumer demand for private-label wines? Are certain grape varieties, styles, or price points gaining more traction?

White wines have been quite popular, with a big pull for Sauvignon Blanc. We also have requests for lower alcohol wines, lighter reds, unoaked styles, sustainable wines, organically grown grapes, and sustainable packaging. Our price point lands us in the $9.99-$15.99 retail price.

Image: LGI Wines - Private Label wines.

One of the advantages of private label wines is offering premium quality at accessible prices. How does LGI balance cost efficiency with maintaining high-quality standards?

With a total production of 4 million cases / yr., we get economies of scale in the procurement of dry goods and efficiency at the bottling level and with our winery partners. Since we only focus on exclusive brands, we do not build an expensive marketing budget into our pricing. We offer our clients the best price possible, which means more margin for the retailer.

Our partners are certified IFS-BRC, and our teams are very involved in quality control to maintain high standards.

LGI works with growers across the South of France, from Languedoc to Gascony. How does this regional diversity help LGI cater to different segments of the US wine market?

When you add the production of the Languedoc and Gascony regions, it represents almost 30% of France’s total production (Languedoc is 25%). It has a multitude of terroirs, resulting in an amazing diversity of wine. This allows us to respond to different segments of the market.

Historically, the Languedoc planted many varietals, which gives us the flexibility to offer different products across many profiles.

Image: Harvesting at Languedoc vineyards.

What are the biggest hurdles private label producers like LGI face in the US wine market? How do you navigate these challenges?

Some challenges we face in the US are:

The change in consumption patterns with the younger consumers who favor RTDs and other products. How do we capture their attention and bring them over to the wine category? We try to offer easy-to-understand packaging that is more relaxed and welcoming. We also produce French wine with a modern style: our wines are approachable, easy to understand, and follow the consumer’s palate.

The consolidation of distribution can affect the route-to-market. Here again, flexibility is key. Being able to pivot and find solutions with our customers and foster our import and distribution partnerships.

Right now, one of the biggest challenges is the uncertainty of the tariffs on European imported wines, but once again, we will adapt our offering and find solutions with our import partners to continue providing great wines at competitive prices.

The US wine market has faced some downturns in recent years. How has LGI adapted to maintain strong sales growth despite industry-wide slowdowns?

We are constantly working on our offering. Bringing new styles to market, improving packaging, designing relevant labels, listening to customer needs, and trying to respond quickly to those shifting demands while staying true to quality and our core values. Being close to our clients all over the world and discussing their challenges helps us adapt and maintain strong sales.

Image: Private Labelling at LGI wines.

Where do you see LGI Wines in the US market over the next five to ten years? Are there new product categories or trends you’re particularly excited about?

We will keep investing in growing our customer base and increasing our presence in the US.

New trends emerge every day, and we discuss them as a team, choose which ones we want to explore, and do a lot of product development and testing. Right now, we are adding more light whites and reds to our portfolio as we increase our low-alc selection. We also offer more alternative packaging, but overall, improving sustainability has been a big focus at LGI over the past few years. (Most of our wines are now HVE certified.)

Conclusion

As the US wine market continues to evolve—nudged by demographic shifts, retail consolidation, and broader beverage competition—LGI Wines is not trying to outshout anyone. Their strategy is subtler: be present, be useful, and keep adapting. Whether it’s through flexible production models, lighter styles, or approachable packaging, the goal is the same: to help partners thrive in a fast-moving landscape.

For Sophie de Lamer Pike and her team, the future of private labels isn’t just about offering another bottle on the shelf. It’s about crafting solutions that resonate, both with retailers and the people buying their wine. In a crowded and often noisy industry, that kind of quiet focus might be exactly what makes LGI stand out.

In conversation with Malvika Patel, Editor and VP, Beverage Trade Network

Also Read:

Beyond Volume: How Sudvin is Elevating Bulk Wine in a Changing Market

Blends, Trends, and Markets: How Parras Wines is Adapting to the Future

LCW’s Approach to Bulk Wine: Quality, Adaptability, and Sustainability

If you're a bulk wine or bulk spirits supplier, contract bottler, or private label producer aiming to connect with serious trade buyers, IBWSS San Francisco 2025 is the event you can't afford to miss. Get a quotation or Book a exhibitor table.